A strategic consultancy and market research firm

Gira knows food – and most of the actors in the European food chain. We operate in the drink and food sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish and dairy.

Contact usOUR OFFICE

-

13 chemin du Levant FR – 01210 Ferney Voltaire, FRANCE

-

+33 450 40 24 00

-

contact@girafood.com

-

Is ASF in Vietnam Significant to the Global Pig Industry?

- Home

- Meat

- Is ASF in Vietnam Significant to the Global Pig Industry?

ASF in Vietnam – Significant to the Global Pig Industry?

Since ASF appeared in China in mid-2018 the World’s pork industry has rightly been fixated by the implications for the global industry. As ever, evidence of ASF’s spread in China is poor, but what is now clear is that the disease is widespread, apparent in every pig province. It is still heavily under-reported, but it is clear that the initial spread was rapid, that farms have liquidated stock into the market spreading the disease faster and further, and that those farms have been slow to restock, dramatically reducing availability in 2019. The implication in China is that 2019 production will be down by at least 6% over the year, and will be far worse at the peak. This will push up pork prices, and pull imports… the early signs of these imports are visible in today’s market.

What became obvious in late 2018 was that ASF would spread out of China, and early reporting of unusual FMD cases in Vietnam pointed to its arrival in the market by December 2018. A reluctance to report cases of ASF has likely allowed ASF to again spread faster and further than might have been the case, although current official reporting suggests it is only around Hanoi in the North; unofficial reports suggest it is national.

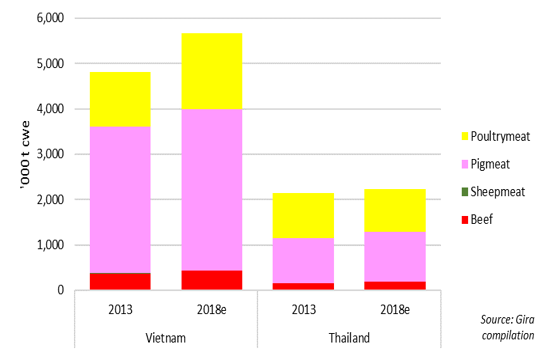

Whilst the Vietnamese pork market is insignificant compared to China, it is over 3.5 mio t cwe with growth of +3.4% p.a. over the last decade, with nearly no official imports. Pork is the most important meat in the market (36% of total meat, although fish is more important in the overall protein balance), with 2017 peak per capita consumption of pork at 40kg/yr. The cultural importance of pork in a fast-developing economy leaves the government with a serious issue; how do they fill the inevitable supply gap?

Figure : Vietnam vs Thailand Meat Consumption by Species, 2013, 2018e

The challenge in Vietnam is in some ways worse than China. The pig industry is modernising, with just 2 notable modern sow producers (CPF and Japfa) who sell weaners to the local market. However, the fattening stage is still largely in the hands of small-scale producers, with very few large-scale farms. The slaughter industry is even more fragmented, and the supply chain to wet markets relies on informal slaughter in villages and an onward chain of middle men to distribute hot pork across the market. ASF will devastate the backyard industry.

The solution for pork supply will come in multiple phases;

- Firstly, the market will be short, prices will be high and consumers will eat less pork. Chicken will likely benefit, as will illicit imports.

- Secondly investors will push into integrated production; some will be linked to the existing sow operations who will need to create an outlet for their weaners.

- Imports will increase access, and higher prices will encourage the major shippers to invest in developing the route to market. A lack of refrigerated distribution will slow, but not stop this.

- There is no quick recovery for one of the regions booming pig industries. The process will be reset, and modernisation at a farm level is the only solution to a disease that will be endemic.

From Vietnam, ASF will spread rapidly in SE Asia, with Vietnam’s long porous borders already used to the movement of both livestock and meat. ASF will be in Laos and Cambodia in months, and is likely to be in Thailand soon afterwards. Pork is the major meat consumed in Thailand, although like Vietnam fish is the major protein. The Thai industry is better placed to cope, but again will need a rapid round of consolidation at farm level to offset the loss of the numerous small-scale producers.

The SE Asian pig industry is facing an interesting period; strong demand for pork is going to be met with a production void in markets traditionally averse to meat imports. Those producers with enough scale on farm to implement biosecurity protocols should reap the benefits of a boom market (as we are currently seeing in China), but must accept the occasional break down as part of the process… and for those who wish to import pork into Vietnam, ASF is the moment to open the door.

Gira is continually analysing the Asian pork market as a part of its global meat and dairy sector research. For further information, please contact Rupert Claxton at rclaxton@girafood.com.

Tags:

Recent news

- Insights from Hybrid Product Webinar by Gira x HMT

- Gira will share expert insights at the South East Future of Farming Conference 2025

- Webinar Invitation: Cracking the Code in the Hybrid Dairy & Meat Market

- The Gira Meat Club annual meeting is back in Geneva this December!

- Meet Gira’s industry experts at SIAL 2024!

Copyrights © 2018 - Gira, All Rights Reserved | Legal mentions - Privacy policy