A strategic consultancy and market research firm

Gira knows food – and most of the actors in the European food chain. We operate in the drink and food sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish and dairy.

Contact usOUR OFFICE

-

13 chemin du Levant FR – 01210 Ferney Voltaire, FRANCE

-

+33 450 40 24 00

-

contact@girafood.com

-

Plenty has been written about the spread of ASF in China in 2019, it is clear to all that it is the Black Swan event of a generation, and that the cases far outstrip those that can be reported. Declines in production vary, but most annalists are now talking about a decline of 20%-30% in 2019, and Gira believes there will be a further decline in 2020.

Plenty has been written about the spread of ASF in China in 2019, it is clear to all that it is the Black Swan event of a generation, and that the cases far outstrip those that can be reported. Declines in production vary, but most annalists are now talking about a decline of 20%-30% in 2019, and Gira believes there will be a further decline in 2020.

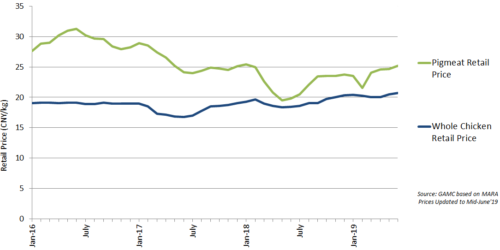

But there’s a serious anomaly, the Chinese pork retail price has not reacted to what must by now be a significant fall in availability of pork on the Chinese market. A decline of 24% in production means there is 13mio t less product available, prices should be sharply up. In fact they are up, +12% in June’19 on 2018 average (better than chicken +8%). But pork was at an a serious low in 2018, if we compare June’19 prices to 2017 average prices (a more normal year), then pork prices are down -2% (not in itself damming as 2017 was a year of falling pork price), but chicken is +16%…

Chinese Meat Retail Prices in CNY – Monthly

The initial discussion on why prices are not reacting has focused on stocks of pork built up during culling, and these certainly existed. Its also quiet probable that some traders have been withholding product in the hopes of a strong price movement. But even so, there is not the storage capacity for the levels suggested, and in a market of 54mio t, monthly consumption of 4.5mio t would have exhausted stocks by now.

The alternative explanation is the previously unthinkable… Chinese consumers are avoiding pork, the meat that makes up 35% of per capita protein consumption, only topped by fish (41% in 2018). But this appears to be the case.

Evidence is building that this is the case, although largely based on examining other parts of the meat supply chain. Chicken prices have increased markedly through 2019, despite production being ramped up (although limited by availability of breeding stock).

Imports have sharply increased of other meats. Jan-April 2019 increased +54% for beef and +47% for poultry (mainly chicken). But volumes fall well short of filling the gap left by pork, and questions about the sustainability of these volumes remain.

The more concerning evidence is that pork import volumes were only up 8% over the same time period! Although this was early days in the crisis, and domestic pigs were still being culled, it is interesting that at a time when beef and poultry grew by close to 50%, pork lagged.

Update October 2019: Gira has just published a crisis study on the mid-term implications for the global meat industry of Chinese ASF. The brochure is available at this link. For further information, please contact Rupert Claxton at rclaxton@girafood.com.

Tags:

Recent news

- Insights from Hybrid Product Webinar by Gira x HMT

- Gira will share expert insights at the South East Future of Farming Conference 2025

- Webinar Invitation: Cracking the Code in the Hybrid Dairy & Meat Market

- The Gira Meat Club annual meeting is back in Geneva this December!

- Meet Gira’s industry experts at SIAL 2024!

Copyrights © 2018 - Gira, All Rights Reserved | Legal mentions - Privacy policy