A strategic consultancy and market research firm

Gira knows food – and most of the actors in the European food chain. We operate in the drink and food sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish and dairy.

Contact usOUR OFFICE

-

13 chemin du Levant FR – 01210 Ferney Voltaire, FRANCE

-

+33 450 40 24 00

-

contact@girafood.com

-

ASF in China: The Local and Global Ramifications

- Home

- Meat

- ASF in China: The Local and Global Ramifications

The spread of ASF is rapidly changing the outlook for the world pork market, with significant uncertainty and challenges lying ahead in Q4 2018, which will spill over into 2019. Two new countries have declared outbreaks over the last 2 months, first China and then Belgium, with a serious chance that Germany and France could join the list in the very near future.

The Chinese situation is as yet far from clear, with 18 declared cases across half the country, and with significant distance between them. This suggests that the Chinese have a very big problem, which will soon impact market supplies and prices, in a big way. However, to date, pandemonium has not arrived! The Chinese government has banned the movement of live pigs and meat from infected provinces, and live pigs from neighbouring provinces. This is clearly good risk management, if it is not already too late. They are monitoring the situation though the local districts, slaughtering all pigs on infected farms, and paying compensation of RMB800 per pig slaughtered. This is well below market value (which is likely to be a very false economy), although an increase in the compensation payment is possible, but not clear.

The impact to date is that live pig prices are up +25% in the last 6 weeks in provinces that were reliant on live pig supply from neighbours (as they are now short of supply). No surprise that the price is sharply down in the (mainly northern) provinces from where production was ‘exported’. The bigger implication is that many Chinese farmers are destocking for fear of contracting ASF, and so there is some additional short term supply in the market. The outlook for 4Q18 is challenging and uncertain, with Chinese importers waiting for more clarity before they commit. But time is running out: Last orders of imports for Chinese New Year (which is the annual cyclical price peak of the market) are usually placed by mid-October.

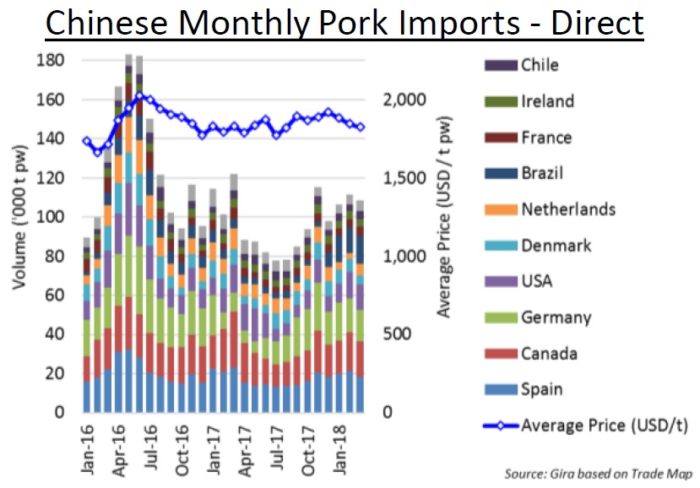

The challenge of where imports may come from is also a serious issue. The US is restricted by retaliatory tariffs, which at +62%, have effectively blocked them, whilst EU exporters that provided a surge in volume in 2016 and have dominated the import share since then are unlikely to match these volumes again as they lack the stocks that existed in 2016 (post Russian import sanctions). The spread of ASF within the EU also throws uncertainty over market access. With ASF being identified in wild boar in early September, Belgium is already blocked from exporting to six key countries (including China and South Korea), which is a serious issue for them, and could get worse. However, there is a much more serious threat of ASF spreading into Germany and France. This will have a dramatic and immediate downward impact on the EU price, and will limit their third country exports. Will intervention stocks be opened again?

The challenge of where imports may come from is also a serious issue. The US is restricted by retaliatory tariffs, which at +62%, have effectively blocked them, whilst EU exporters that provided a surge in volume in 2016 and have dominated the import share since then are unlikely to match these volumes again as they lack the stocks that existed in 2016 (post Russian import sanctions). The spread of ASF within the EU also throws uncertainty over market access. With ASF being identified in wild boar in early September, Belgium is already blocked from exporting to six key countries (including China and South Korea), which is a serious issue for them, and could get worse. However, there is a much more serious threat of ASF spreading into Germany and France. This will have a dramatic and immediate downward impact on the EU price, and will limit their third country exports. Will intervention stocks be opened again?

There are few real winners in all this. Canada may have the strongest position, and Brazil will make the most of what access it has to China. Gira will update the picture as it becomes clearer – and in any event, ASF and the escalating trade disruption between the US and China will be key themes during our annual Gira Meat Club meeting in early December.

Gira is continually analysing the Chinese meat and dairy market as a part of its global meat and dairy sector research.

Gira is continually analysing the Chinese meat and dairy market as a part of its global meat and dairy sector research.

For further information, please contact Rupert Claxton at rclaxton@girafood.com.

Tags:

Recent news

- Insights from Hybrid Product Webinar by Gira x HMT

- Gira will share expert insights at the South East Future of Farming Conference 2025

- Webinar Invitation: Cracking the Code in the Hybrid Dairy & Meat Market

- The Gira Meat Club annual meeting is back in Geneva this December!

- Meet Gira’s industry experts at SIAL 2024!

Copyrights © 2018 - Gira, All Rights Reserved | Legal mentions - Privacy policy