A strategic consultancy and market research firm

Gira knows food – and most of the actors in the European food chain. We operate in the drink and food sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish and dairy.

Contact usOUR OFFICE

-

13 chemin du Levant FR – 01210 Ferney Voltaire, FRANCE

-

+33 450 40 24 00

-

contact@girafood.com

-

What does import demand look like in Asia post ASF and Covid-19 demand shock?

- Home

- Gira news

- What does import demand look like in Asia post ASF and Covid-19 demand shock?

Following a tough 2020 year, Asian economies are back on track for growth in 2021, leading to a recovery in food consumption almost everywhere. If there is no doubt about the recovery of consumption as a whole, recovery of foodservice is likely to be more muted, as the Covid-19 pandemic continues to play out at a global level. But China will experience a positive a evolution (already starting in Q4 2020), as it seconomic growth once again surges.

In 2021 the region will start to recover from a massive pork supply drop caused by Asian ASF.

The supply stress caused by the drop in supply was partly offset by Covid-19 demand shocks, which softened the impact of ASF by reducing demand for meat in Asia.

On the production side, 2021 will be characterised by the recovery of China: after having lost about 50% of its pig herd from the 2018 level, recovery began in Q4 2020. In 2021 production should increase by not less than 21% on 2020 (which saw a 30% drop). This result will be achieved thanks to drastic industry restructuring, moving from traditional backyard production to modern intensive production, and an aligned chilled supply chain.

Meanwhile, poultry production has continued to increase despite the impact of the pandemic throughout part of 2020: white broiler sales suffered as restaurants and canteens closed for several months, and yellow broilers sales plunged as live wet markets shut down. But the supply kept on increasing, as both small farmers and large integrators pursued expansion, filling the gap left by a falling pork supply. And expansion is likely to continue throughout 2021, boosted by recovering demand.

In other Asian countries, the ASF story is somewhat similar to China, but with less investment capacity to restructure the sector. In Vietnam, pork production should rebound by a modest 3% in 2021, following a 41% drop in 2020. The restructuring process of the industry is underway but far from being complete. Also, in the Philippines, the decrease in pork production will not hit the lowest level before mid-2021.

Nevertheless the ASF crisis and the Covid-19 related disruptions will undoubtfully leave a supply gap in the region, in particular in South East Asia.

Let’s start with Vietnam, which is of immediate interest for Russian companies. Vietnam’s economy has been hit by Covid-19, GDP growth dropped from +7% to +2.5% but it is one of the few countries managing to remain positive in 2021, and the mid-term GDP growth is on average +6.5% p.a. Increased meat demand is driven by rising urbanisation, an emerging middle class with rising wages, and the development of sales through modern retail, e-commerce and foodservice channels.

The outlook for pork and poultry consumption is very positive, with nearly 12% p.a. CAGR for pork to 2025 in Vietnam (keeping in mind that 2020 was low due to ASF, but even so the growth will be remarkable) and 5% growth for poultry. ASF has given a push to both pork and poultry production, boosting the development of large scale farms, however this won’t be sufficient to meet demand. Imports will therefore continue to increase, possibly reaching a total of 1.2 mios t for both species by 2025!

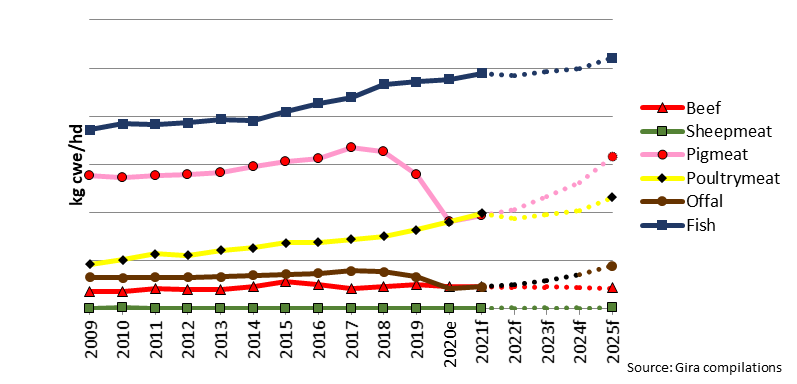

Consumption by species in Vietnam, 2009-2025f

The Philippines was badly hit by ASF and the situation is expected to get worse in 2021 despite investments. It took some time until the government officially recognised the reality of the pandemic, and at that time the disease had already spread to islands outside of Luzon (Manilla region, the main market). Then Covid-19 broke out, placing the archipelago in a strict lockdown situation and making it difficult to accelerate the move from backyard to industrial farming, whilst at the same time leading to high levels of unemployment. Poultry production, which is largely controlled by integrators and large commercial farms, had a tough 2020 year due to massive imports to compensate the pork shortage but the sector should be back on track for growth starting 2021, due in part to demand recovery as the immediate demand impact of Covid-19 fades.

But the result is that in the medium term the country should remain far from self-sufficiency with import volumes continuing to rise of both pork and poultry.

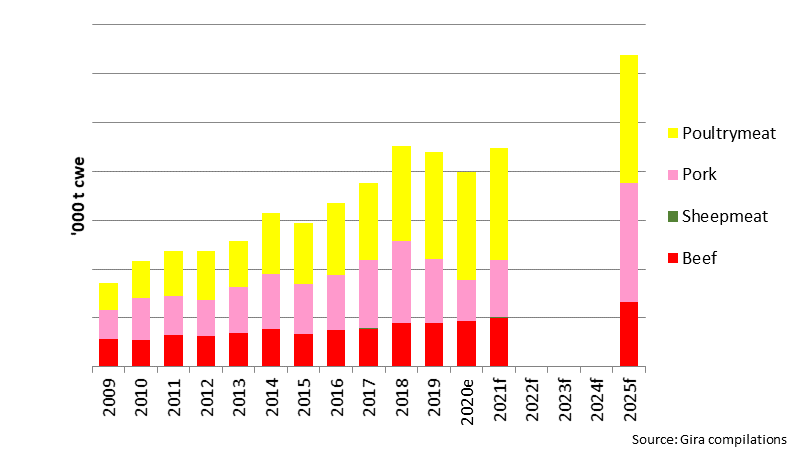

Imports by species in the Philippines, 2009-2025f

In North Asia also, import demand is likely to stay high: China should continue to be world’s n°1 importer of pork, and even if Russia’s direct access to China remains questionable, it is going to attract large volumes from major global exporters, and thus give space to Russia on other markets. Japan (the world’s second pork importer) and South Korea, mainly supplied by North America and EU, will also increase their import volume of pork, at significantly higher values than the Chinese market. By 2025 Chinese import volumes will be falling, as the Chinese pig industry has largely recovered post ASF, leading to a decline in import volumes, whilst growth in other Asian markets can not compensate for the loss of China.

In North Asia also, import demand is likely to stay high: China should continue to be world’s n°1 importer of pork, and even if Russia’s direct access to China remains questionable, it is going to attract large volumes from major global exporters, and thus give space to Russia on other markets. Japan (the world’s second pork importer) and South Korea, mainly supplied by North America and EU, will also increase their import volume of pork, at significantly higher values than the Chinese market. By 2025 Chinese import volumes will be falling, as the Chinese pig industry has largely recovered post ASF, leading to a decline in import volumes, whilst growth in other Asian markets can not compensate for the loss of China.

What does it mean for Russian companies?

So far Russia is severely limited in exports of pork by its own positive ASF status, but hopefully this will be less a limiting factor for the medium term due to acute supply shortages in Asia. The poultry situation in better now in terms of market access but competition from other producers (notably Brazil and the USA) is tough, especially if the RUB regains momentum. But large Russian players have all understood that in a context of shrinking margins and tough global environment, focus is on cost efficiency improvement, and obviously on biosecurity.

For more information please contact Véronique Aguera (v.aguera@girafood.com) or Rupert Claxton (rclaxton@girafood.com).

Follow us at Gira – A Girag & Associates Company to keep up to date on our latest news and events.

Copyrights © 2018 - Gira, All Rights Reserved | Legal mentions - Privacy policy