A strategic consultancy and market research firm

Gira knows food – and most of the actors in the European food chain. We operate in the drink and food sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish and dairy.

Contact usOUR OFFICE

-

13 chemin du Levant FR – 01210 Ferney Voltaire, FRANCE

-

+33 450 40 24 00

-

contact@girafood.com

-

Cell-based: should meat companies get involved?

- Home

- Gira news

- Cell-based: should meat companies get involved?

Gira recently reviewed developments in the cell-based meat market for our Gira Asia Meat Club annual meeting in Bangkok and have compiled the most interesting extracts for you to take away for free.

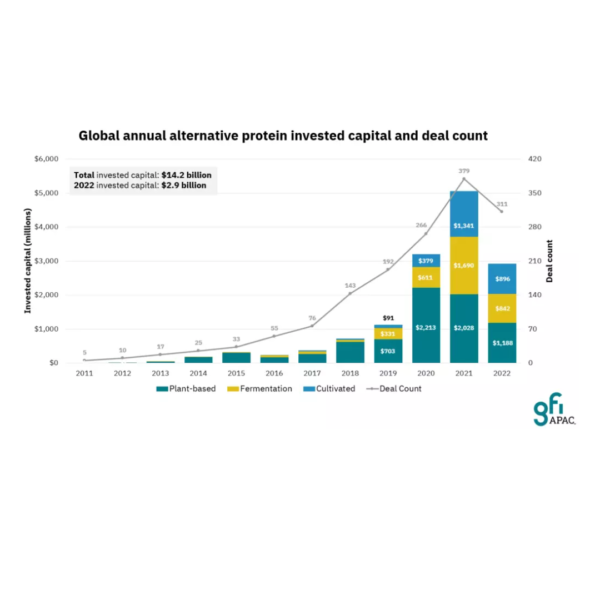

Source : Good Food Institute

After a period of rapid expansion in the alternative meat protein market, investments within this market are becoming more selective. Why? On the one hand, the global economic situation has become more problematic as a result of the war between Russia and Ukraine, with the resulting inflationary period. On the other hand, final products are not always up to consumers’ expectations, be it in terms of price, organoleptic qualities or nutritional characteristics; the list of ingredients, for example, remains a blocking point. Finally, the development of cell-based meat is currently blocked by a lack of commercial markets due to the absence of approvals. Singapore is the only country to have authorised the marketing of cell-based meat, since late 2020.

Singapore is seeing large developments. Esco Aster is planning to open the largest cultivated meat production facility, and works with several startups like Eat Just, Mosa Meat, Aleph Farms and Meatable as manufacturing partners. By 2025, Esco Aster should increase its capacity to 50,000 litres. However, this corresponds to no more than approximately 400-500 tonnes of cell-based meat per year, far from the 410,000 tons of meat consumed in Singapore every year (76.5kg per capita).

Large markets could soon open up to cell based. Research on the subject is very dynamic and attracts many public and private investors. Take the case of China for example. Since 2021, cell-based meat has been included in a 5-year plan for the production of alternative proteins. Many start-ups are interested in this topic, including Cell X, which is about to launch the first pilot project in China. In Japan, the Prime Minister expects the country to move forward with a plan to develop an industry of “cell agriculture” with the objective for cultivated meat and fish to reduce the country’s carbon footprint. In the United States, the FDA has given a safety-clearance to lab-grown meat end 2022. Upside Foods, a California based company, should be able to sell its products in the United States once its manufacturing facilities and products are inspected and then approved and properly labeled. This should be finalised during 2023. Gira expects other countries to follow soon.

Should meat companies go ahead?

If we take the example of the dairy sector, Gira observes that most of the large dairy companies have entered the alternative protein market (Bel, Fonterra, Nestlé, Danone to name but a few). This new segment has been a growth driver and has enabled synergies to be exploited in the areas of supply chain and distribution & marketing, areas within which start-ups in the sector sometimes lack expertise.

The question today is whether companies in the meat/poultry sectors can replicate this model. For the time being, this choice has been made by the Brazilian company JBS. After launching into plant-based in 2021, JBS took a majority stake in a company active within the cell-based market in 2022 (BioTech Foods, ES) and aims to market products from 2024. JBS is capitalising on its Seara brand awareness for its new range of alternative meats. In Brazil, the brand enjoys excellent listings for its plant-based range.

Another example is given by Cargill which partnered with Cubiq Foods (a Spanish company making cultivated fat) to create and scale up novel fat technology to accelerate innovation in plant-based foods, targeting the United States.

However, many challenges remain on the horizon, to name but a few:

Is the future of cell-based products based on finished products or on an ingredient function, improving a plant-based product for example?

Is industrial production viable in the medium term, both in economic terms (price parity through scale up) and in environmental terms?

Will the products satisfy consumers – not only in terms of taste but also in terms of composition?

Would you like to know more?

Contact Veronique Aguera, Rupert Claxton or Laurène Bajard with any specific questions you may have or click on our two latest proposals in the alternatives market hereafter:

- Alternative Protein Outlook to 2031 focusing on the United States & Canada

- Alternative Protein Outlook to 2031 focusing on EU markets

Don’t forget to follow Gira on Linkedin to keep up to date on the latest news in the food industry and at Gira.

Copyrights © 2018 - Gira, All Rights Reserved | Legal mentions - Privacy policy