A strategic consultancy and market research firm

Gira knows food – and most of the actors in the European food chain. We operate in the drink and food sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish and dairy.

Contact usOUR OFFICE

-

13 chemin du Levant FR – 01210 Ferney Voltaire, FRANCE

-

+33 450 40 24 00

-

contact@girafood.com

-

Boom Time for Chinese Pork Imports - But what next?

- Home

- Gira news

- Boom Time for Chinese Pork Imports – But what next?

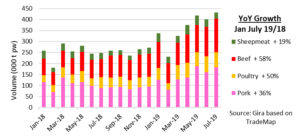

Since ASF swept into China in 2018 the global pork industry has been waiting for the inevitable jump in pork imports. Trade in the first half of 2019 did not meet the expectations of the global industry: whilst beef and poultry imports boomed, pork made slower gains.

Since ASF swept into China in 2018 the global pork industry has been waiting for the inevitable jump in pork imports. Trade in the first half of 2019 did not meet the expectations of the global industry: whilst beef and poultry imports boomed, pork made slower gains.

The pork prices in China (producer and retail), told a story of weak demand as consumers shied away from pork due to their ASF concerns: and oversupply, as producers culled pigs that were either sick or they feared were at risk. Slaughter companies stockpiled cheap pork, waiting for the inevitable drought… but after a small jump in April’19 the pork price remained soft.

That changed in July’19 as pork prices in China boomed. By August the retail price blew though the historic ceiling price of RMB31/kg… and kept going. The Politburo were suddenly paying attention, and it was time for an all-out effort to “fix” the problem, with a raft of support measures directed at rebuilding production!

Monthly Chinese Meat Imports, Jan-18 to Jun-19

Imports of pork have finally started to show the potential the rest of the world was expecting. So far the biggest winners have been the EU exporters, notably from Spain and Germany. These exporters were already established, and are free of the political issues limiting the supply to China from both Canada and the US. The Brazilian exporters are making notable progress, although from a low base, and could well be a serious winner from ASF in the mid-term.

Imports of pork have finally started to show the potential the rest of the world was expecting. So far the biggest winners have been the EU exporters, notably from Spain and Germany. These exporters were already established, and are free of the political issues limiting the supply to China from both Canada and the US. The Brazilian exporters are making notable progress, although from a low base, and could well be a serious winner from ASF in the mid-term.

Imported pork demand is expected to increase in 2020, with a full year of imports needed to help offset the shortfall in supply, and this will lead to higher pork prices globally. Import volumes will ultimately be limited by availability for China on the world market, not by demand for imports from China being met. This will be reflected in both global and Chinese prices throughout 2020.

There are a few countries that can increase production for export to China, notably the US, Canada, Brazil and select EU countries. Most others have limiting factors, that will prevent further investment. This means that increased export volumes for China will be made available by robbing the domestic markets of exporters (in many cases low prices in recent years point to over supply) and from diverting exports from other, low value markets, such as Africa.

The global industry can not fill the forecast shortfall in Chinese pork supply, and despite both increased chicken production and imports, the market will remain short of meat, and high prices will persist. This will lead to a period of high profitability in the Chinese meat sector, underpinning the rebuilding of China’s pork industry, around a modern integrated core.

Gira has just published a crisis study on the mid-term implications for the global meat industry of Chinese ASF. The brochure is available here. For further information, please contact Rupert Claxton at rclaxton@girafood.com.

Copyrights © 2018 - Gira, All Rights Reserved | Legal mentions - Privacy policy