A strategic consultancy and market research firm

Gira knows food – and most of the actors in the European food chain. We operate in the drink and food sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish and dairy.

Contact usOUR OFFICE

-

13 chemin du Levant FR – 01210 Ferney Voltaire, FRANCE

-

+33 450 40 24 00

-

contact@girafood.com

-

Adding value to milk proteins

High protein concentration is no longer enough

If ten years ago, producing WPC70 or MPC70 was a pledge of high technical skills, membranes filtration technologies have improved greatly and the race for the highest protein content has almost stopped, 80-90% being the new norm. Less concentrated powders are increasingly considered as commodities, with their price subject to volatility being the main consequence. In this highly competitive environment, between dairies, but also from alternatives (soy, rice, pea, etc.), how can milk/whey protein producers differentiate their product?

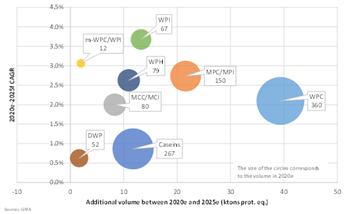

Production of technical dairy ingredients by product, 2020-2025

Adding functionalities to proteins

One approach to add value to proteins is to focus on the highest bacteriological quality, infant and pharma grades. However, the sector of infant nutrition is not a big user of MPC/MPI and medical nutrition is a relatively minor sector in terms of volume compared to sport nutrition for example (82 ktons of dairy proteins in medical nutrition in 2020, compared to 280 ktons in adult nutrition).

Another possibility is to increase functionalities of dairy protein powders. Relatively quickly dairy protein producers have developed instant powders with a higher solubility than regular versions. Currently the focus is on heat or acid stable proteins to answer technical and organoleptic issues when incorporating these proteins in acid beverages and in processed food products like bars and the increasing range of protein-enriched food products (yoghurts and other fresh dairy products, cakes, ice-cream, beverages, etc.).

High gelling properties is also currently a subject of interest. Indeed at the time of clean label, the use of high-gelling dairy proteins enabling to avoid texturing agents such as starch, carrageenan or guar is an interesting benefit and a competitive advantage compared to plant-proteins which still show some functional weaknesses although they are improving.

Native proteins to add nutritional value

Although membrane filtration is a “soft” treatment, efforts have been made to preserve the native structure of dairy proteins. Native whey proteins and micellar caseins, produced from microfiltration of skimmed milk, emerged in 2016-17. In micellar caseins, protein micelles are not destroyed as with rennet or acid caseins and native whey proteins have not undergone cheese processing treatments. These native proteins not only have better functional properties (higher solubility in particular), but also improved nutritional quality thanks to higher digestibility or bioavailability.

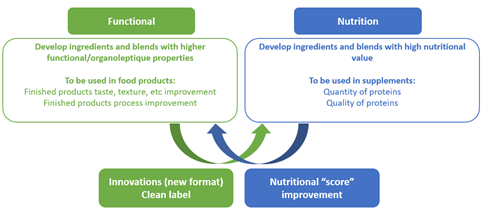

Functional and Nutrition, two business units that are linked

Functional and Nutrition are now current business units in the ingredients segment of dairy companies.

The functional ingredients business consists of simple ingredients or blends dedicated to food manufacturers to improve taste, texture, aspect, shelf-life and storage of their finished products, to optimise recipes and production costs, and to innovate with new formats for instance. These functional ingredients/blends add gelling, foaming, emulsifying, and stabilising properties. Functional dairy ingredients can also help food manufacturers in their clean label approach.

The nutrition business consists of ingredients or blends for the health and nutrition sectors. These ingredients have focused nutritional value: amino acid profile (content in essential amino acids, in particular the branched-chain amino acids), as well as high digestibility and bioavailability.

These two units are linked as nutritional products and are complex matrices that require highly functional ingredients. For instance, adult nutrition is a highly innovative sector where functional ingredients are essential to develop new formats (protein waters, high-protein bars, beverages, etc). In addition, the high protein enrichment of these products often causes a challenge regarding taste and texture of the finished products. In medical nutrition, the high functionalities of ingredients are also crucial to formulate products with a high nutritional density (given the low ingestion capacity of some patients), as well as products with optimised texture for patients with chewing and/or swallowing difficulties.

Blends now appear to be the ultimate way to add value to dairy proteins

These blends are mixes of different ingredients (dairy and sometimes non-dairy) to address a specific purpose, functional or nutritional need. Tailor-made blends are at the top of the value scale, not necessarily because of the intrinsic value of the ingredients used, but because of the service and R&D support offered.

Technical blends are common in the sectors of adult and infant nutrition. The benefits for customers are multiple: decomplexifying of their own supply chains, better purchasing efficiency, capex avoidance, import tariff reasons in some cases. In addition, the base powder manufacturer absorbs any fluctuations in demand.

Blends are also purchased by producers of a wide variety of foods and beverages product categories: fresh dairy products, bakery mixes, ice cream blends, etc. The use of blends by food producers removes the blending process step, improves functionalities and consistency, and simplifies both raw material purchases and inventory management.

Click here to access the “Global market dynamics in Technical Dairy Ingredients Markets to 2025” study proposal. This study describes, measures and forecasts the production, trade and end-uses of the main industrially produced, “technical” ingredients sold in the multiple forms of whey proteins, caseins and milk powders used for human consumption, as well as of standard vegetable fat-filled milk powder. It draws conclusions, illustrates best practice and makes recommendations for operators, while investigating alternative strategies for ingredient/dairy operators to add value by increasing their presence along the value chain.

Would you like to find out how this study can help your business? Contact Mylène Potier or Christophe Lafougere.

Don’t forget to follow us at Gira – A Girag & Associates Company to keep up to date with our most recent news!

Copyrights © 2018 - Gira, All Rights Reserved | Legal mentions - Privacy policy