A strategic consultancy and market research firm

Gira knows food – and most of the actors in the European food chain. We operate in the drink and food sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish and dairy.

Contact usOUR OFFICE

-

13 chemin du Levant FR – 01210 Ferney Voltaire, FRANCE

-

+33 450 40 24 00

-

contact@girafood.com

-

Insights from Hybrid Product Webinar by Gira x HMT

- Home

- Gira news

- Insights from Hybrid Product Webinar by Gira x HMT

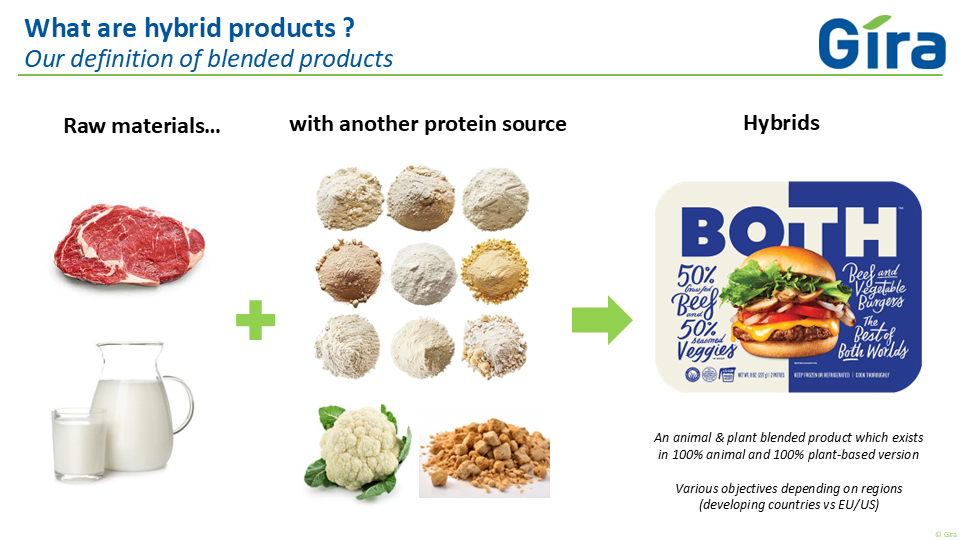

Blending meat or dairy with other food ingredients has been done for decades, particularly in South America and Africa, where they were developed primarily for price or functionality. For example, many sausage and minced meat products contain plant protein in small amounts.

More recently, we have been observing a renewal of this product category, with clear sustainability goal, leading to blends of conventional animal protein (meat or milk) with significant amounts of non-animal protein (ex: plant protein), resulting in a “hybrid” product. The key objectives of these products are to enhance sustainability by reducing the intake of meat or milk, as well as improving the taste and texture of plant-based alternatives.

Players in the food industry are questioning several points. Do these hybrid products have the potential to establish themselves in Europe and North America? Could they appeal to a rising number of flexitarian consumers seeking both nutritional benefits and great taste? Gira and HMT recently hosted a webinar about this hybrid products market. Our team of in-house experts address some of the key questions raised by our webinar participants regarding this developing product category…

What is driving the development of hybrid products?

- Sustainability – Reducing meat and dairy consumption while still enjoying their taste is a strong marketing argument. However, most consumers are reluctant to pay a premium.

- Enhanced nutrition – Combining multiple protein sources to create a nutritionally complete product.

- Enhanced taste and functionality – Hybrid products provide a good solution, especially as they improve plant-based products which often lack taste, juiciness and other functionalities. They can also enhance some dairy spread functionalities.

- Cost reduction at the industry level – Particularly relevant for hybrid meat products, to reduce the use of expensive raw materials (like beef). At the consumer level, price parity with conventional products will be essential for mass-market adoption!

Who will push this market?

Hybrid products are clearly an initiative from the industry, which presents challenges in identifying their target customers and market position. We believe retailers should be the biggest drivers of these products as they need to reduce their scope 3 emission. For example, Lidl in the Netherlands launched a product combining beef (60%) and pea protein (40%) at the end of 2024 (image on right). We expect to see wider developments in meat hybrids than in dairy hybrids.

Hybrid products are clearly an initiative from the industry, which presents challenges in identifying their target customers and market position. We believe retailers should be the biggest drivers of these products as they need to reduce their scope 3 emission. For example, Lidl in the Netherlands launched a product combining beef (60%) and pea protein (40%) at the end of 2024 (image on right). We expect to see wider developments in meat hybrids than in dairy hybrids.

One approach to improve consumer acceptance would be to initiate efforts within the foodservice channel, which could help drive volume and contribute to a silent transition.

Multiple B2B ingredient suppliers are proposing formulations to end-product manufacturers. Quorn, one of the leading plant-based players, is supplying its mycoprotein for blending with meat in foodservice channels in the UK. “From helping a few people eat no meat, to helping everyone eat less meat.”

What about product failures?

Several hybrid products have already been introduced to the market, such as 50/50 burgers and milk blended with almonds. Some hybrid products have succeeded, while others have failed.

Examples: Vion’s Hackplus hybrid meat product was launched in the Dutch market in 2012 but was stopped following disappointing repeat sales. Other examples include DFA’s Live Real Farms who launched the first U.S. hybrid milk blend in 2019 (50% dairy, 50% almond milk), Tyson’s blended burgers from Raised and Rooted and BrewDog with Beyond meat ingredients, to mention but a few.

Key challenges behind product failures:

- High price positioning: price parity remains key for a successful mass-market adoption

- Poor taste and texture

- Consumer perceiving these products as unhealthy processed foods because of their long lists of ingredients

- Confusing marketing, with a lack of clear product positioning and an unclear target audience

- Low consumer awareness and education about the concept of hybrid products

- Limited shelf space and availability at retail level.

Marketing plays a big part in matching consumer’s expectations. What do we tell consumers? Can consumers understand the ‘hybrid’ product concept or is it only an industry specific term?

Still curious to know more?

Watch the full Gira x HMT webinar to discover our experts’ insights and case studies discussed.

Webinar Speakers

For more insights, reach out to our Gira experts: Mylène Potier and Laurène Bajard

Peter Wennström

Founder and expert consultant at HMT

Marit Veenstra

Brand & Innovation Strategist at HMT

Don’t miss HMT’s latest article about the takeouts from the webinar.

Stay connected with us at GIRA – A Girag & Associates Company to keep informed about the insights from our in-house experts, their current activities, and the latest developments at Gira within the food industry. Additionally, feel free to explore our Reports Page to learn more about Gira’s ongoing projects.

Tags:

Copyrights © 2018 - Gira, All Rights Reserved | Legal mentions - Privacy policy