A strategic consultancy and market research firm

Gira knows food – and most of the actors in the European food chain. We operate in the drink and food sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish and dairy.

Contact usOUR OFFICE

-

13 chemin du Levant FR – 01210 Ferney Voltaire, FRANCE

-

+33 450 40 24 00

-

contact@girafood.com

-

Highly Pathogenic Avian Influenza (HPAI) is getting closer than ever to Brazil, a major producer and exporter of poultry worldwide.

Can export markets really afford to shut out Brazilian poultry if avian influenza breaks out?

We are currently crossing the worst episode ever of Highly Pathogenic Avian Influenza (HPAI) and its reach is now worldwide. The current challenge started in October 2021 in the Northern hemisphere, resulting in the culling of 140 million birds in 2022. Close to 20 million birds have already been culled in 2023, making a strong impact on poultrymeat production and trade (HPAI is used as a barrier to raw meat trade). Even if the pace of this outbreak is slowing down in some countries, others are only starting to be infected.

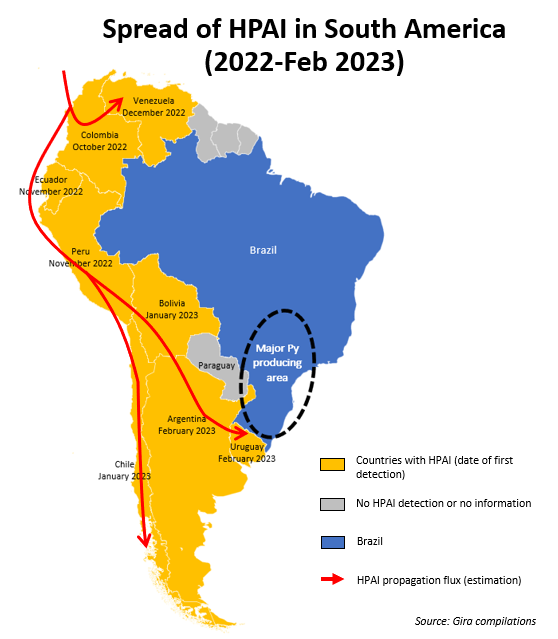

Avian influenza started to spread all over South America in October 2022, and Brazil, currently clear of infection, is especially threatened. The Brazilian sector took strong protective measures, but it is now highly probable that HPAI will be confirmed in Brazil, the question is of when? The south of Brazil is the main producing and exporting area, and is closest to Uruguay and Argentina, which both already have the current HPAI strain. The North of Brazil is less sensitive, covered by rainforest. With little export driven commercial production, and little testing, it is reasonably treated as a different zone!

The spread of avian influenza in Brazil would have strong repercussions on domestic poultrymeat production volumes and price, but also on other commodity markets, such as feed ingredients (corn and soy) and other meats. The depth of this situation would depend on the severity and speed of the spread of an outbreak, as well as how the Brazilian press manages media coverage. A human death from HPAI in Brazil could cause a significant reduction in consumption.

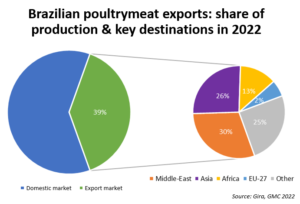

Moreover, the industry is turned towards export markets, with over 39% of production destined to foreign markets in 2022. The detection of HPAI in Brazil could immediately suspend exports to key destinations. This already happened in the cattle industry: the detection of one case of Bovine Spongiform Encephalopathy (BSE) in February 2023 suspended beef exports to China and other countries (leading to a fall of beef export volumes by 50%). Lower (or no) exports would bring about lost valorisation of certain parts (feet, MDM, etc.) and lost revenues and could lead to several bankruptcies in the sector, as some production plants are mainly aligned to export supply, and not the domestic market.

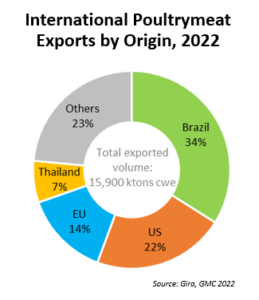

Few alternatives to Brazilian exports. Brazil is the first exporter of poultrymeat in the world, assuming 34% of total export volumes, and 5% of the total global consumption. Other key exporters (such as the US, EU, Thailand, …) could take advantage of the situation, however, they all have limited supply, different product ranges, and some are already struggling with HPAI outbreaks.

Can export markets really afford to shut out Brazilian poultry? Will they move to regionalisation rather than total bans? Who would be the winners and losers? There is an urgent need to re-evaluate HPAI policies, as so much of the world’s poultry market and industries at risk of disruption from HPAI.

Contact Rupert Claxton, François Cadudal, Richard Brown or Laurène Bajard with any specific questions you may have on HPAI.

Don’t forget to follow Gira on Linkedin or to add Gira News to your favorites to keep up to date on the latest news in the food industry and at Gira.

Check out our Meat Reports page for details on available and upcoming publications at Gira.

Copyrights © 2018 - Gira, All Rights Reserved | Legal mentions - Privacy policy